Principal Investigator: Dr. Brittany Lewis

Contributing Authors: Olivia Wilks, Madonna Morris, Yue Zhang, Arundhathi Pattathil Sasikumar and Dr. Shana Riddick

Between 1993 and 2022 Hennepin County shelter policy included some form of a “pay-to-stay” provision requiring shelter guests to forfeit all or most of their income to remain in shelter. Following a growing call to reform this policy, a coalition formed in 2020 between the Center for Urban and Regional Affairs (CURA), shelter leaders at People Serving People, Research in Action (RIA), Hennepin County leaders, and the Pohlad Foundation to explore an alternative to the self-pay model.

Employing participatory action research strategies, this collaborative engaged current and former shelter guests to develop an innovative financial empowerment program that eliminated pay-to-stay obligations, provided savings opportunities, and administered financial empowerment classes.

Between November 2021 and April 2022, People Serving People launched this pilot program, Families for Finance (FFF). CURA served as the evaluation partner examining both program development and program implementation. In 2022, Hennepin County eliminated the self-pay policy, citing in part an earlier CURA report highlighting the impact of self-pay on individuals facing housing instability. Eliminating self-pay was a victory for families and advocates alike, but impacted enrollment in the voluntary pilot as the FFF Program was an attractive alternative to self-pay.

Despite this challenge and the immense impact of COVID-19, this report provides an account of the innovations that can occur when a program is developed by and for shelter guests, opportunities to continue to improve the FFF program going forward, and recommendations to the field for future community-driven initiatives.

Lessons Learned and Recommendations for Future Community-Driven Initiatives

Limited Self-Pay Literature

In seeking information on self-pay policies and programs to inform the FFF program development, CURA discovered there was limited scholarly literature on this phenomenon.

We see value in further exploring and understanding how self-pay shelter policies are implemented in the U.S.

Family-Driven Program Design

Our program design process was informed by the Equity in Action model3 developed by Research in Action4, an action research, community engagement, and racial equity consulting firm. The design of the FFF program was driven by impacted families through the FFEC Action Committee. By fostering an environment in which families with lived experience could design and develop a program for families in shelter, we believe the FFF model resonates more closely with the needs of families than it otherwise would have.

We encourage other entities seeking to develop effective programming to empower impacted individuals, families, and communities to drive the process.

Gap in Field Expertise Related to Financial Trauma

The design of the FFF program revealed that 1) traditional financial literacy programs do not address financial trauma despite its stated importance as a prerequisite to seeking financial empowerment and 2) there is a gap in the professional sector to lead and train in the field of financial trauma and empowerment.

We recommend that:

Financial trauma be embedded into financial literacy courses, particularly those aimed at communities of color facing systematic economic disempowerment, and

The human services sector should invest in professional development related to financial trauma because of its potential role in fostering sustainable economic stability.

Agility and Responsiveness to Program Participants

After the completion of the FFF pilot, PSP staff have modified the program to be more accessible to families by offering all program elements in an “a la carte” manner.

We believe programs working with families experiencing hardship should replicate this prioritization of flexibility and continuous effort to eliminate participation barriers.

Matched Savings

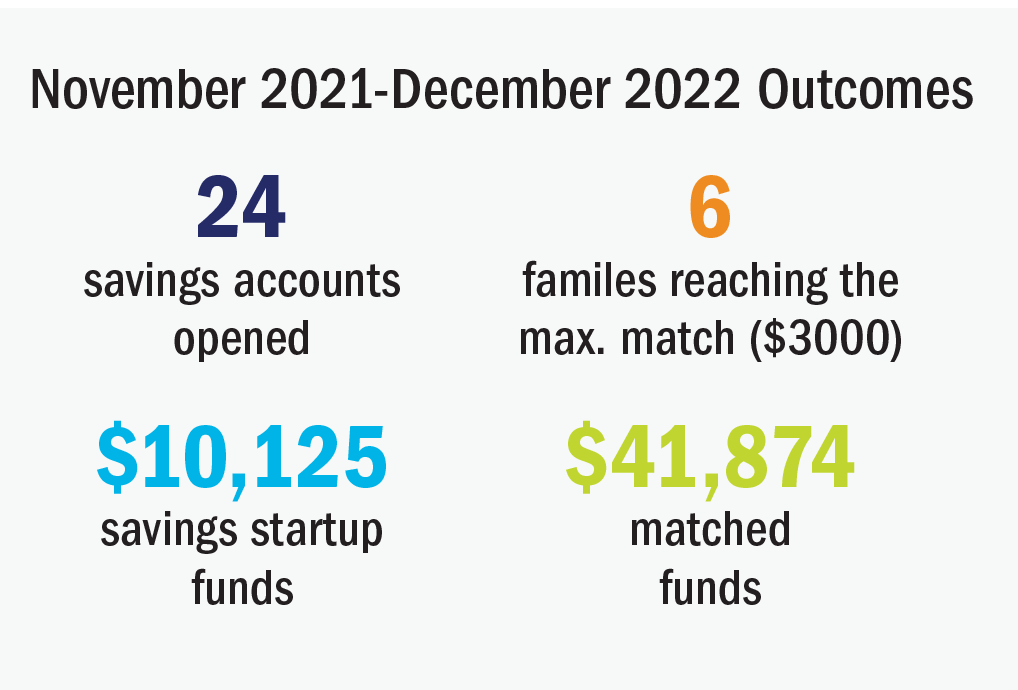

We recommend that other programs seeking to address poverty and/or to support housing stability consider implementing matched savings programs. PSP provided matching savings to families during and after the pilot was completed, the table below represents the impact this program element has had on families between November 2021 and December 2022.

Impact of Benefits Cliff

In order to eliminate this barrier for families, we recommend that all local counties and social service providers build upon the momentum of the passage of Minnesota Family Investment Program six-month budgeting periods, Medical Assistance continuous eligibility for minor enrollees, and Housing Support Income modifications and seek additional opportunities to mitigate the impact of the benefits cliff.