Excerpt from the USDA Section 515 Report Executive Summary

Authors: Ryan Allen, Susan Bergmann and Max Geitz

Illustrations by Kia Lee, Graphic Designer

Major Findings

As of 2020, the Midwest, defined in this report as Minnesota, Wisconsin and Iowa, had a total of 1,158 Section 515 properties providing 25,561 units of affordable housing. Midwest Section 515 properties accounted for 8.6 percent of the total number of Section 515 properties in the U.S., and 6.2 percent of the total number of housing units in the Section 515 program.

- The Midwest will see large proportions of its Section 515 properties mature out of the program earlier than the U.S. overall. The peak of mortgage maturations for Section 515 properties in the Midwest will occur in 2030, about 10 years before the peak in mortgage maturations occurs for Section 515 properties in the U.S.

- The unique characteristics of Section 515 properties in the Midwest relative to Section 515 properties in the U.S. suggest that some policy responses may need to be tailored to fit the unique needs of the program in the Midwest.

- The average size of a Section 515 property in the U.S. is 31 units. In comparison, the average in Minnesota and Iowa is 21 units, while the average in Wisconsin is 24 units. The smaller scale common in the Midwest suggests that owners may have less capacity to absorb costs related to capital maintenance and complex real estate transactions compared to owners of larger properties

- Nearly 40 percent of Midwest Section 515 properties are owned by non-profit organizations, about double the proportion of Section 515 properties owned by nonprofit organizations in the U.S. Non-profit organizations active in rural areas are often small and less able to manage large amounts of financial risk or complicated tasks associated with raising capital and navigating government programs.

- Midwest Section 515 properties are more likely to be used by seniors, with over 40 percent of Midwestern Section 515 projects designated for seniors compared to one-third of Section 515 projects in the U.S.

- Changes in the housing market in many rural counties and in the Section 515 program itself have made it less attractive to private owners and investors. On the other hand, mission-driven owners have maintained a strong interest in the 515 program as one of the few affordable housing resources available to rural communities.

- Stakeholders in the Section 515 program expressed concern with Section 515 program rules and the impact of those rules on project cost and viability. Some concerns identified included the lengthy exit/transfer process, the use of other subsidies such as rental assistance, and how Section 515 program rules interacted with rules governing other affordable housing programs.

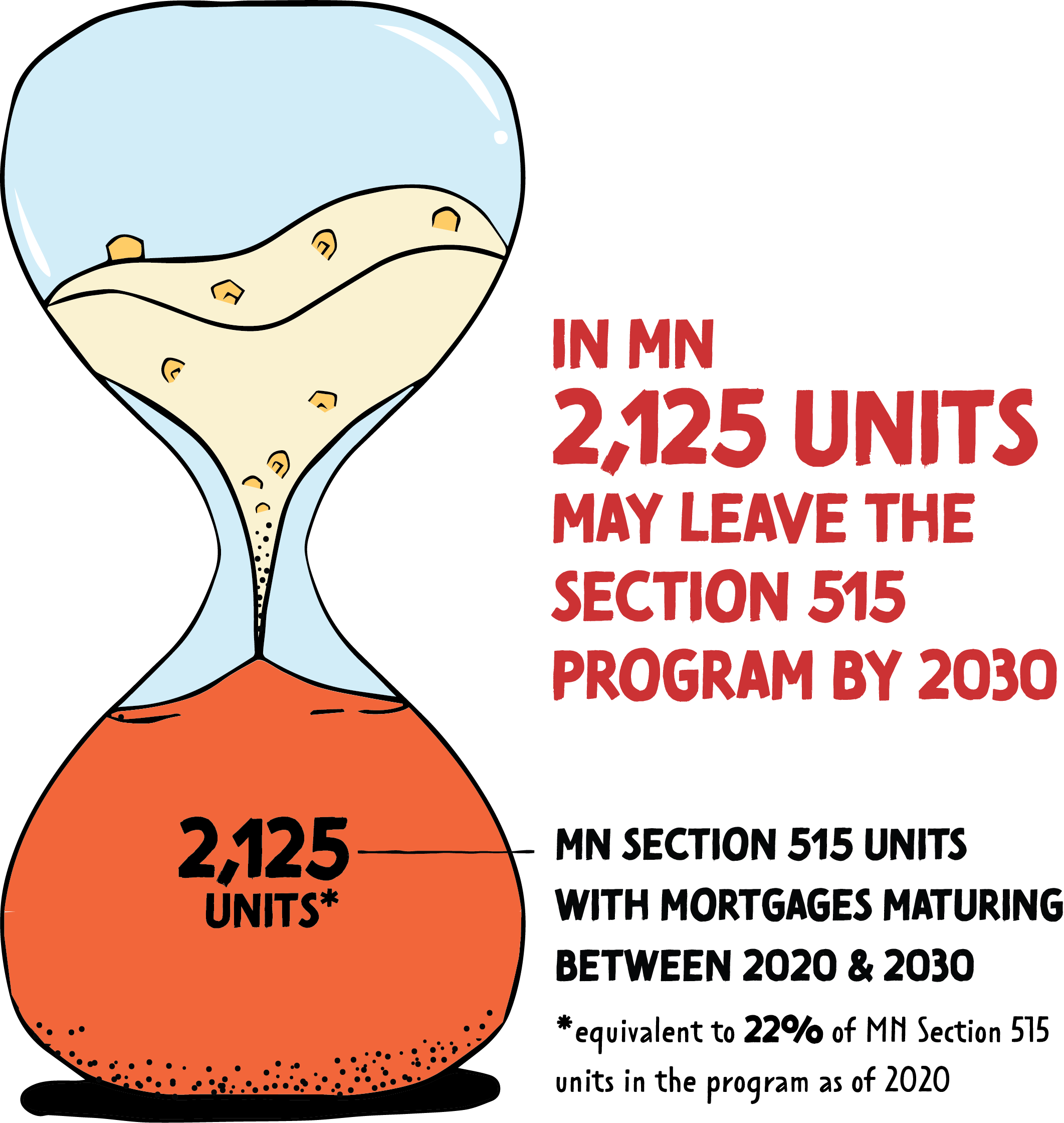

- To illustrate the severity of the situation, in Minnesota, we estimate that 2,125 Section 515 units will mature and potentially leave the program by 2030. This is equivalent to 22% of the 9,597 Section 515 units that were in the program as of 2020.

Full USDA Section 515 Reports

- The USDA Section 515 Program and the Challenge of Preserving Affordable Housing in Greater Minnesota, Qualitative Analysis

- The USDA Section 515 Program and the Challenge of Preserving Affordable Housing in Greater Minnesota, Quantitative Analysis

Acknowledgements

The USDA Section 515 Report was supported by the Center for Urban and Regional Affairs in partnership with the Minnesota Housing Partnership and the Housing Justice Center. This research was supported by several different CURA programs, including a Faculty Interactive Research Program (FIRP) grant to Humphrey School of Public Affairs Professor Ryan Allen, a Kris Nelson Community-Based Research Program graduate research assistant, mapping by Community Geographic Information Systems and artwork produced by Kia Lee for the Public Policy Design Lab.